south dakota excise tax on vehicles

However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. 32-5B-14 - Licensing and payment of excise tax on new vehicle by dealer.

South Dakota Taxes Sd State Income Tax Calculator Community Tax

By the applicant will be subject to the 4 excise tax as of the date of this documentsubject to law changes If the purchase.

. Vehicles that have not been titled or registered in the US. 32-5B-13 - Licensing and titling of used vehicle by dealer--Payment of tax by subsequent purchaser. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car.

911 Emergency Surcharge Prepaid. In addition interest and penalties will apply to the 4 motor vehicle excise tax once the 45 days has lapsed with additional interest due on the 60th day after purchase. South Dakotas excise tax on cigarettes is ranked 23 out of the 50 states.

Chapter 10-36 Rural Electric Companies. No excise taxes are not deductible as sales tax. Uses the product or service in a municipality that.

Motor vehicles are not subject to the motor vehicle excise tax if. Chapter 10-35 Electric Heating Power Water Gas Companies. The purchaser requests and.

Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial. Mobile Manufactured homes are subject to the 4 initial. That is subject to sales tax in South Dakota.

84-Insurance company titles vehicleboat and does not pay 4 excise tax. South Dakota charges a 4 excise sales tax rate on the. Get all the information you will need to title or renew your vehicle registration and license plates for your commercial vehicles.

In addition to taxes car. South dakotas licensing fees help counties pay for road repairs and the state collects a 3 percent excise tax on vehicles purchased and then licensed in south dakota. For vehicles that are being rented or leased see see taxation of leases and rentals.

2010 South Dakota Code Title 32 - MOTOR VEHICLES Chapter 05B - Excise Tax On Motor Vehicles. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Section 32-5B-1 - Imposition of tax--Rate--Failure to pay as misdemeanor.

The South Dakota excise tax on cigarettes is 153 per 20 cigarettes higher then 54 of the other 50 states. Vehicles in South Dakota. Your browser is not supported.

If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. Sales and excise taxes are two separate taxes that many people pay attention to because they. 2013 South Dakota Codified Laws Title 32 - MOTOR VEHICLES Chapter 05B - Excise Tax On Motor Vehicles 32-5B-1 Imposition of tax--Rate--Failure to pay as misdemeanor.

In South Dakota an ATV MUST be titled. All the documents you need to register fast. Please update your browser or download one of the following browsers.

Sales Tax On Cars And Vehicles In South Dakota

What Is South Dakota Sales Tax Dakotapost

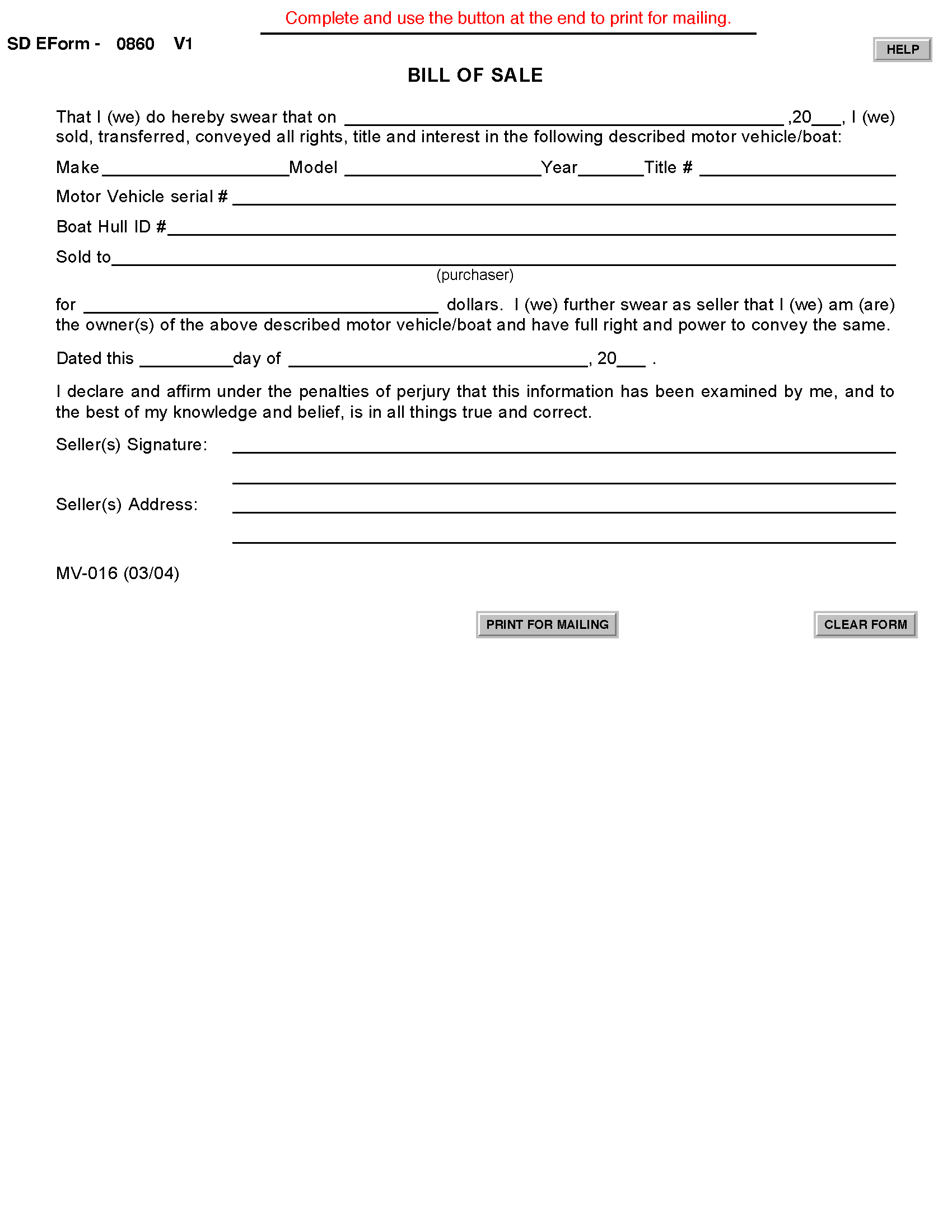

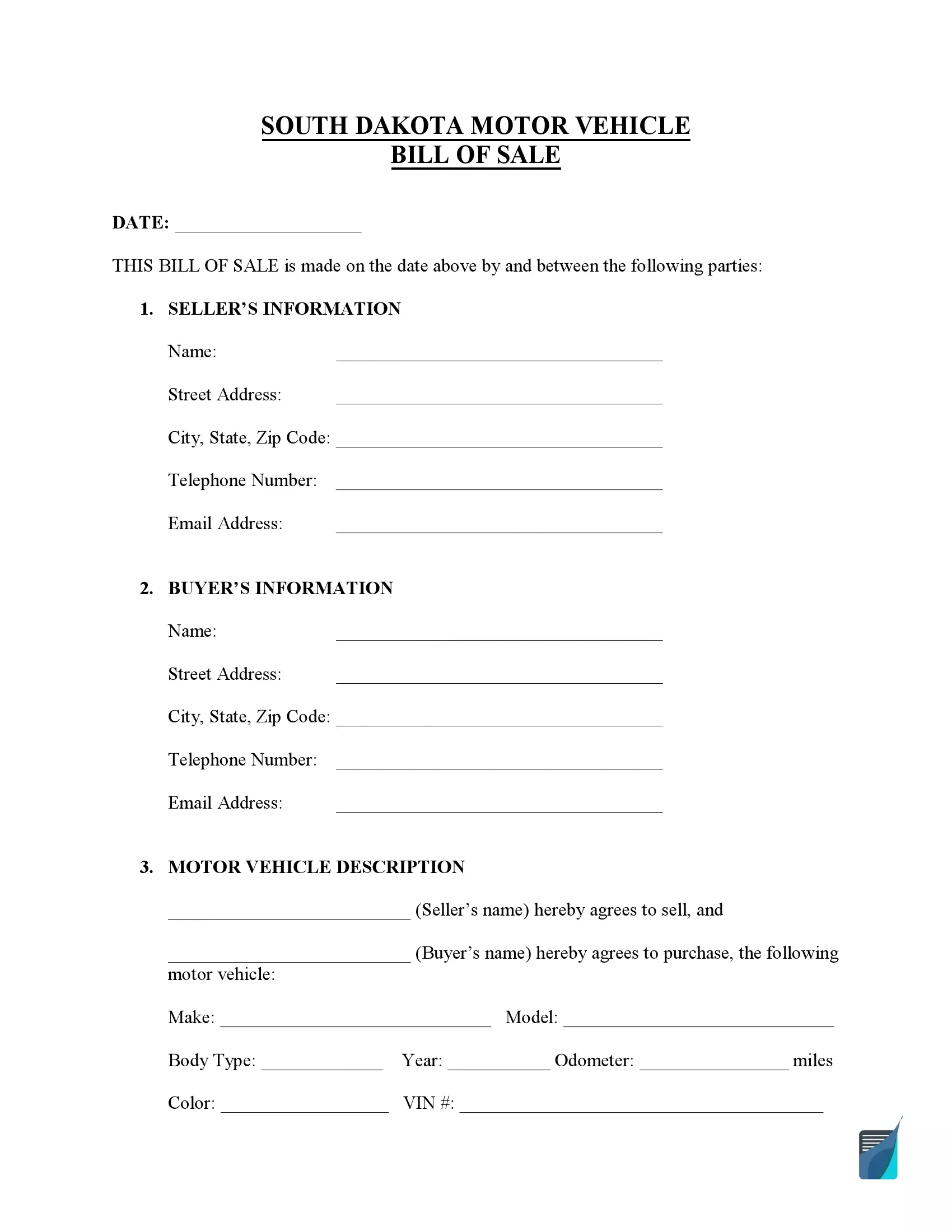

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

South Dakota License Plate License Plates In South Dakota Dakotapost

South Dakota License Plate License Plates In South Dakota Dakotapost

Individual Faqs South Dakota Department Of Revenue

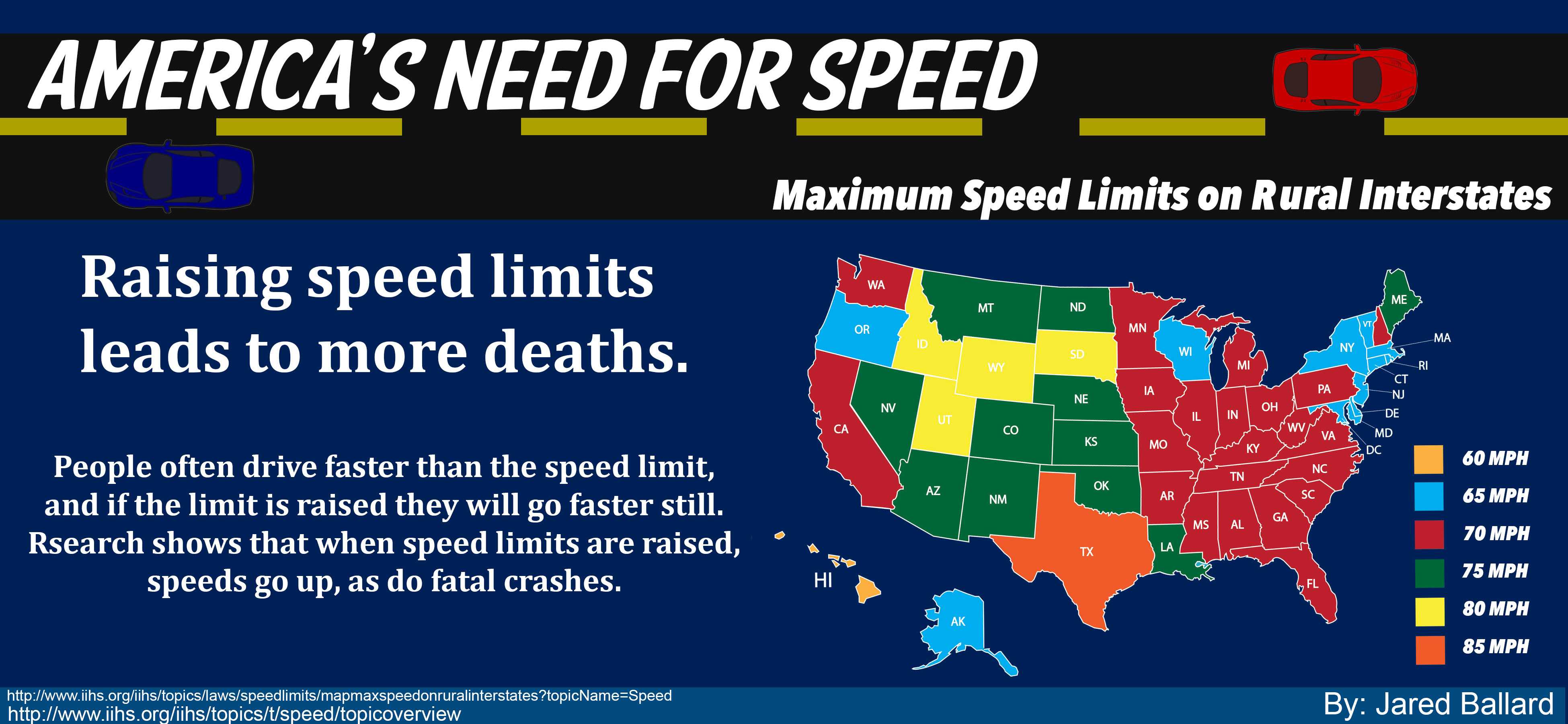

Speed Limit Rises In South Dakota Bhsu Media

What Is Excise Tax And How Does It Differ From Sales Tax

Motor Vehicles Sales Amp Repair State Of South Dakota

Sales Taxes In The United States Wikipedia

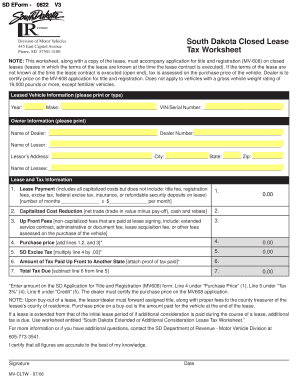

South Dakota Lease Tax Worksheet Fill Online Printable Fillable Blank Pdffiller

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

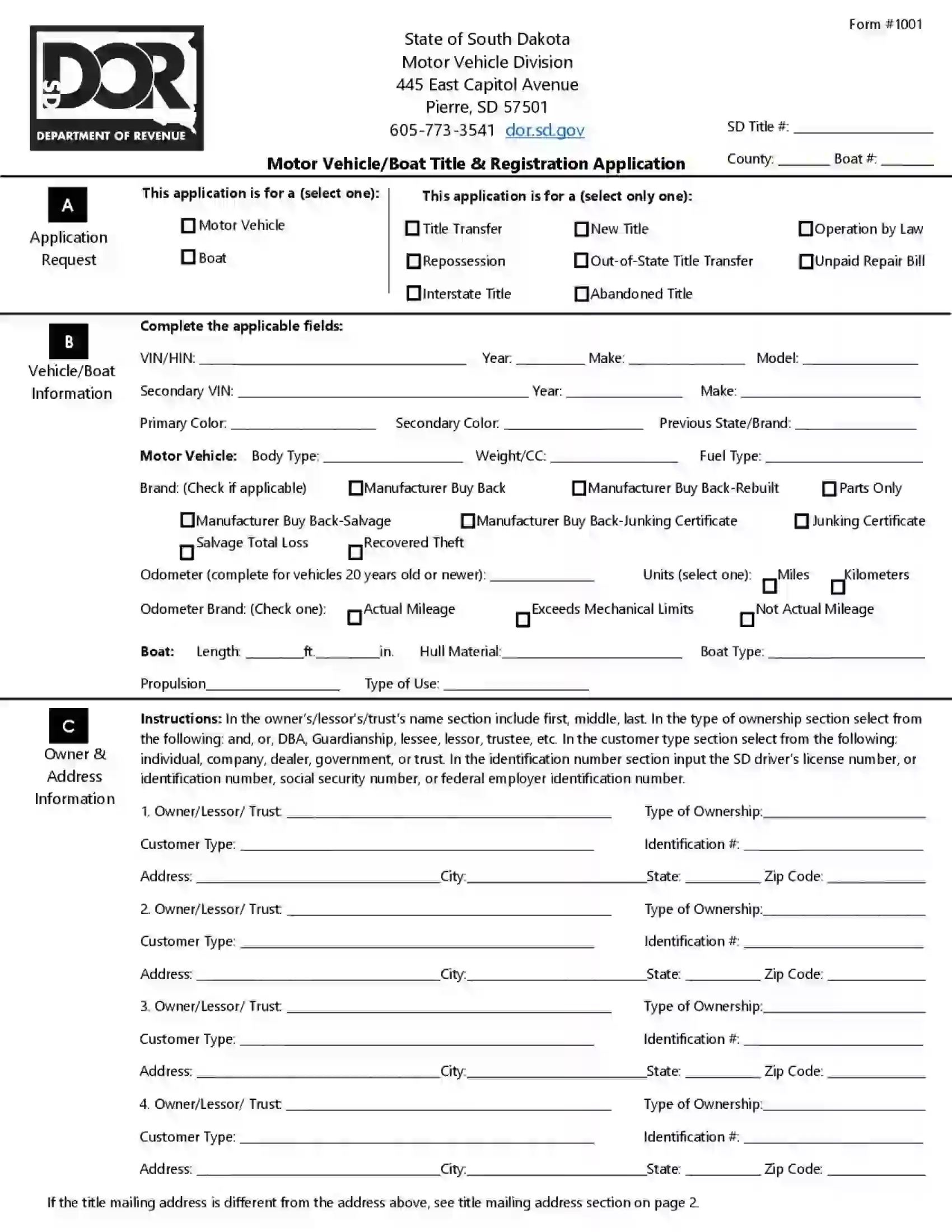

Cars Trucks Vans South Dakota Department Of Revenue

South Dakota Department Of Revenue Facebook

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Bills Aims To Triple Tax Michigan Car Sharing Industry Michigan Thecentersquare Com

Car Rental Taxes Reforming Rental Car Excise Taxes